Many investors are now diversifying their investment portfolios with the help of Exchange Traded Funds (ETFs) and exchange-traded notes (ETNs). The difference between ETFs and mutual funds is that they can be traded throughout the day on an exchange, whereas traditional open-ended mutual funds only trade at the end of the day, which means you can’t buy or sell during market hours. An investor will purchase either a fund share or a fractional share depending upon their intended holding period. These two types of investments have many things in common but differ in other important ways.

ETFs are similar to traditional index funds

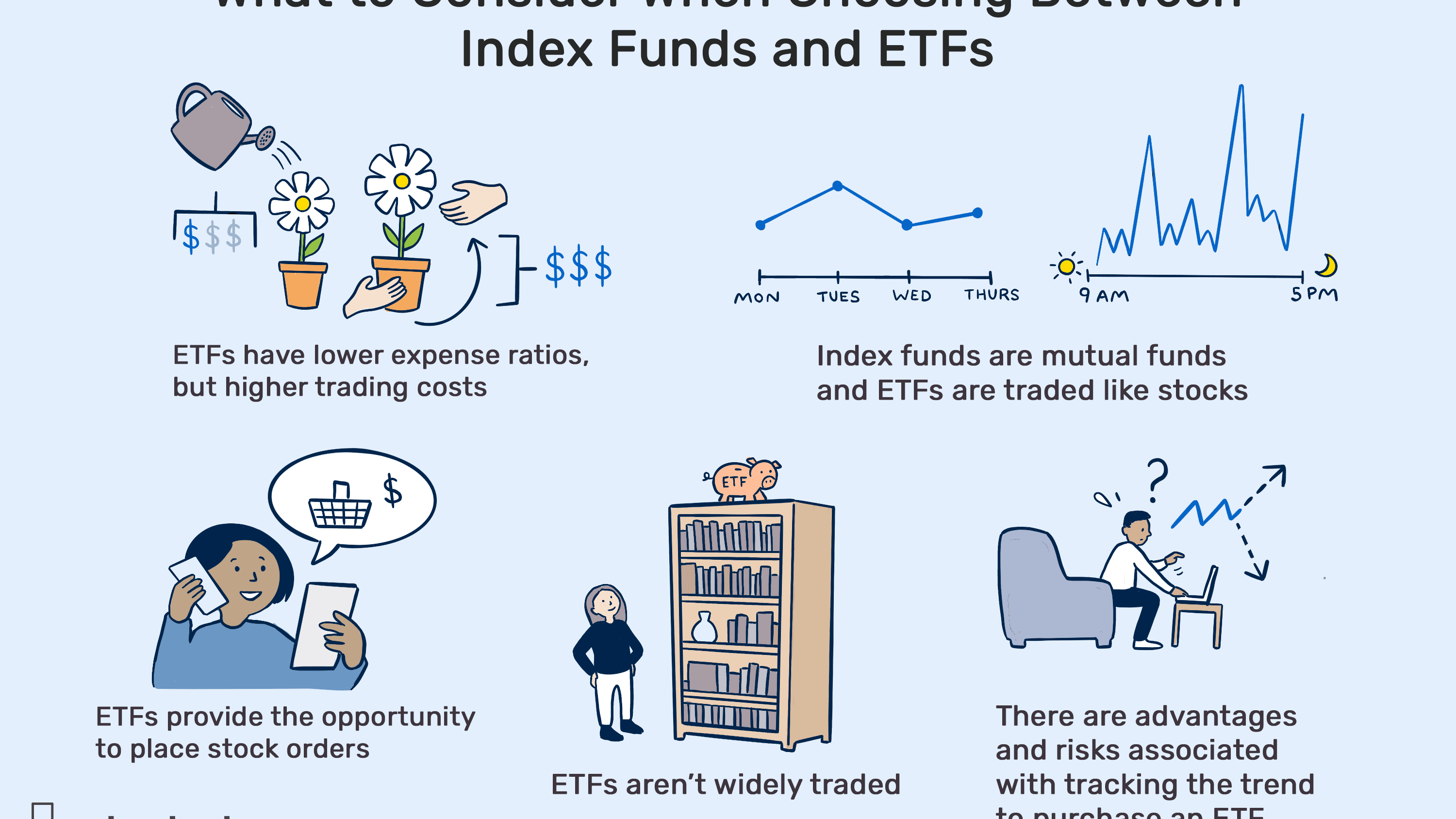

ETFs are similar to traditional index funds, which seek to track an underlying benchmark index by owning all of its component stocks directly or indirectly through derivatives. The difference is that ETFs trade like a common stock on an exchange. They are bought and sold throughout the day at market prices, which means you need to be aware of current market conditions before investing in them.

ETFS charge lower fees than mutual funds

ETFs have become a popular choice among investors because they typically charge lower fees than traditional open-ended mutual funds do. In addition, there is no minimum investment amount required for opening an account with most brokers. You can buy or sell as little as one share at a time, and you will only be charged a commission once if your purchase immediately increases your shares outstanding by 1,000%.

Since ETFs typically have low expenses, more money is available to grow your investments. It allows passive index ETFs in particular to outperform similar actively managed mutual funds. ETFs are also considered “tax-efficient” because they generate less taxable income than actively managed mutual funds do. Find more info here.

Liquidity

The most significant difference between ETFs and traditional open-ended mutual funds is liquidity, which can be either a pro or a con depending upon your situation. Traditional open-ended mutual funds allow investors the ability to purchase or redeem their fund shares at any time during market hours. Because of this reason, it’s essential for an investor only to invest money that won’t need to be touched for many years into open-ended mutual funds since their underlying securities will fluctuate with the markets daily; you don’t want to wake up one day and realize that your money has shrunk significantly due to a bear market. In addition, mutual funds typically require a minimum initial investment of $1,500 or more before you can invest in them.

High daily liquidity with low bid-ask spreads

On the other hand, ETFs typically have very high daily liquidity with low bid-ask spreads and commissions. It’s beneficial for investors who need to take advantage of market opportunities right away. However, this also means that they are traded like stocks. So an investor must pay attention to how their portfolios will be affected by current market conditions before investing in them. Suppose you decide to use ETFs as long-term investments for ten years or more. In that case, you may wish to switch into open-ended mutual funds instead since those tend to closely match the performance of their underlying index over very long periods, despite daily fluctuations.

Mutual funds are more appropriate for large sums of money

Mutual funds are typically more appropriate for investors who want to invest a large lump sum of money and don’t need to touch it for many years. ETFs are better suited for investors who wish to take advantage of market opportunities as they come up or those who prefer more control over what they invest in since ETFs can hold any asset class you choose. In contrast, mutual funds are constrained by indices or sub-classes that the fund manager decides to track. Both ETFs and mutual funds serve similar purposes, although the differences discussed above may affect an investor’s choice depending on their unique circumstances.

Bottom line

An investor should do plenty of research of the top stock newsletters before investing in either mutual funds or ETFs to ensure that they are adequately diversified, have proper asset allocations and understand the risks associated with whichever investment vehicle they choose.